Title loan regulations vary by region, with San Antonio having specific rules. These laws ensure consumer protection through transparent disclosures of interest rates, repayment terms, and fees. The process involves application, vehicle inspection, and signing paperwork, with title transfer as collateral. Borrowers must understand their rights and local regulations to avoid default and debt cycles, especially for commercial vehicle owners.

Title loans, a quick source of cash secured by your vehicle’s title, come with crucial regulations designed to protect consumers. If you’re considering a first-time title loan, understanding these regulations is essential. This guide breaks down the basics of title loans and delves into navigating their regulatory requirements. You’ll learn about key consumer protections, ensuring an informed decision in this fast-paced financial landscape.

- Understanding Title Loan Basics: A Primer for Beginners

- Navigating Regulatory Requirements: What You Need to Know

- Protecting Consumers: Key Rules and Rights Explained

Understanding Title Loan Basics: A Primer for Beginners

Title loans are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This alternative financing option is popular among individuals who need quick cash and may not have excellent credit. In exchange for the loan, lenders hold onto the vehicle’s title until the debt is repaid in full. Once the loan is fully paid off, the borrower regains ownership of their vehicle’s title.

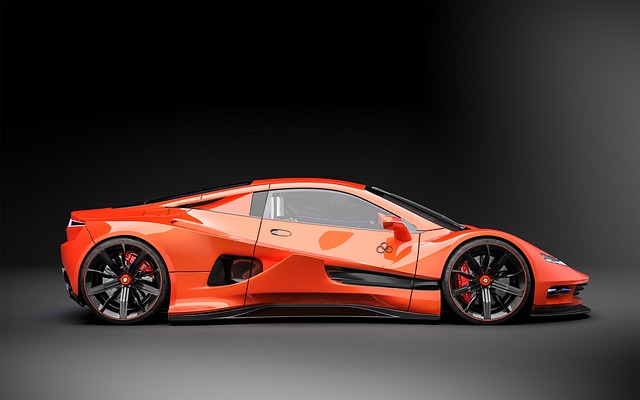

Title loan regulations vary by state, but generally, borrowers must provide proof of car ownership and a government-issued ID. The process typically involves filling out an application, having the vehicle inspected to determine its value (known as vehicle valuation), and signing the necessary paperwork. For example, in San Antonio loans, lenders often offer truck title loans as part of their services, catering to the diverse financial needs of the community. Understanding these basics is crucial for first-time users navigating the world of title loans and ensuring they make informed decisions within the framework of local regulations.

Navigating Regulatory Requirements: What You Need to Know

Navigating Regulatory Requirements: What You Need to Know

When considering a title loan for the first time, understanding the regulatory landscape is crucial. Title loan regulations vary from state to state, so it’s essential to familiarize yourself with the rules in your area. These laws are designed to protect consumers and ensure fair lending practices. Key aspects include verification of identity, income, and vehicle ownership, as well as transparent disclosure of interest rates, repayment terms, and potential fees.

One important regulatory requirement is the title transfer process. This involves legally transferring the ownership of your vehicle to the lender until the loan is fully repaid. Additionally, borrowers should be aware of their rights and options, such as loan extensions if needed, which can help them manage unexpected financial challenges without defaulting on their loans. Truck title loans, for instance, often come with specific regulations that cater to the unique needs of commercial vehicle owners.

Protecting Consumers: Key Rules and Rights Explained

When it comes to Title Loan Regulations, consumer protection is a top priority for financial authorities. These rules and rights are designed to safeguard borrowers from predatory lending practices and ensure they have a clear understanding of their obligations. One of the key protections is the transparency requirement, where lenders must disclose all terms, interest rates, and fees upfront, ensuring first-time users are fully aware of what they’re agreeing to.

Additionally, these regulations limit the number of loan refinancings allowed, giving borrowers breathing room and preventing them from getting trapped in a cycle of debt. The process also involves a thorough review of the title transfer, verifying the ownership and value of the asset being used as collateral. This step is crucial in protecting both the lender and the borrower, ensuring that the transaction is legitimate and the assets are properly assessed.

Title loan regulations are designed to protect both lenders and borrowers, ensuring fair practices in this type of lending. By understanding the basic concepts, navigating regulatory requirements, and recognizing your consumer rights, you can make an informed decision about a title loan—a valuable step for first-time users looking for quick financial support. Remember, knowledge is power when it comes to managing your finances.