Title loan regulations are crucial for protecting borrowers and promoting fair lending practices. They cover interest rates, repayment terms, and collateral processes, preventing debt traps. Transparency empowers consumers, especially those with poor credit. These rules allow individuals to use vehicles as collateral for short-term loans, offering an alternative to traditional banking. Enforcement through inspections and digital technology ensures compliance with rate caps and other limits. While challenging, these regulations protect borrowers, foster fair practices, and provide a safer lending environment.

Title loan regulations play a crucial role in protecting borrowers from predatory lending practices. This article delves into the intricate world of these regulations, offering a comprehensive overview of their understanding and enforcement mechanisms. We explore how regulatory bodies ensure compliance, highlighting the impact on both lenders and borrowers. By balancing safety and access, these regulations foster a fair and transparent title loan market, safeguarding consumers while promoting responsible lending.

- Understanding Title Loan Regulations: A Comprehensive Overview

- Enforcement Mechanisms: How Regulators Ensure Compliance

- Impact on Lenders and Borrowers: Balancing Safety and Access

Understanding Title Loan Regulations: A Comprehensive Overview

Title loan regulations are a crucial set of rules designed to protect borrowers and ensure fair lending practices in the alternative financing industry. These regulations govern various aspects, from interest rates and repayment terms to the process of securing collateral, which is typically the borrower’s vehicle. Understanding these regulations is essential for both lenders and potential borrowers alike.

The primary objective of Title Loan Regulations is to prevent predatory lending and ensure that consumers are not burdened with excessive debt. They mandate clear disclosure of interest rates, fees, and repayment schedules, enabling borrowers to make informed decisions. For those with bad credit seeking quick cash, these regulations provide a framework that allows them to keep their vehicle as collateral while accessing short-term funding. This approach offers an alternative to traditional loans, catering to individuals who may not qualify for other financial products.

Enforcement Mechanisms: How Regulators Ensure Compliance

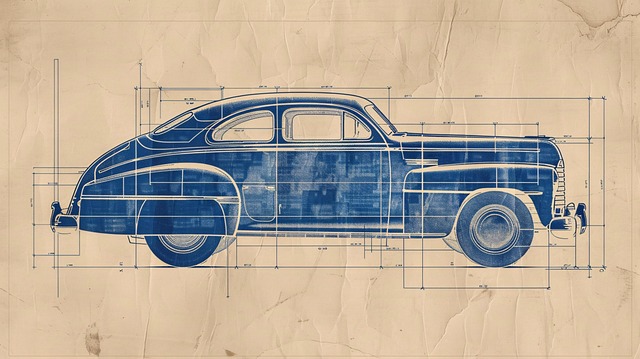

Enforcement mechanisms play a pivotal role in ensuring that lenders adhere to the stringent rules governing title loan regulations. These regulatory bodies employ several strategies to monitor and verify compliance, acting as a deterrent for any potential violations. One primary method is through on-site visits and inspections, where regulators examine loan portfolios, financial records, and lending practices. This process includes meticulous reviews of individual loans, focusing on factors like interest rate calculations, repayment terms, and the condition of the secured asset—a crucial aspect, especially when assessing the value of vehicles used as collateral (Vehicle Inspection).

Furthermore, with the rise of digital platforms, regulators have adapted by utilizing advanced technology to track online applications and monitor lending trends. This digital oversight helps identify any anomalies or non-compliance with interest rate caps and other prescribed limits. By combining these traditional and modern enforcement tools, regulatory bodies can effectively navigate the complex landscape of title loan regulations, ensuring that consumers are protected while fostering fair and transparent lending practices.

Impact on Lenders and Borrowers: Balancing Safety and Access

The enforcement of Title loan regulations significantly impacts both lenders and borrowers, striking a delicate balance between ensuring consumer safety and maintaining accessible credit options. For lenders, adhering to strict regulations means additional compliance burdens, including stringent verification processes and transparent disclosure requirements. This can lead to higher operational costs and, in some cases, reduced lending volumes as lenders grapple with meticulous documentation and rate caps, such as interest rates and loan payoff terms.

However, these regulations also protect borrowers from predatory lending practices by setting clear boundaries on fees and ensuring fair treatment. For borrowers seeking short-term financial relief, such as keeping their vehicle to secure a loan, the regulations provide much-needed safeguards. It empowers them to make informed decisions by clearly outlining terms and conditions, preventing them from falling into cycles of debt. Ultimately, this regulatory framework fosters a healthier lending environment, where both parties can navigate with confidence, knowing their rights and obligations are protected.

The enforcement of Title loan regulations is a delicate balance, aiming to protect borrowers while ensuring access to credit. By understanding these regulations and the mechanisms behind their implementation, both lenders and borrowers can navigate this process more effectively. This ensures that the Title loan regulations serve their intended purpose, fostering a fair and secure lending environment without stifling necessary financial services.